Stripe Inc. is a leading fintech company offering flexible and seamless online payment solutions, particularly suited for startups and small businesses. It supports various payment methods, including credit/debit cards and digital wallets like Apple Pay and Google Pay. Stripe provides features like international payment processing, subscription management, and invoicing. Its easy integration with e-commerce platforms makes it a preferred choice for businesses seeking secure, efficient, and accessible payment options.

Key Features of Stripe

- Effortless Integration

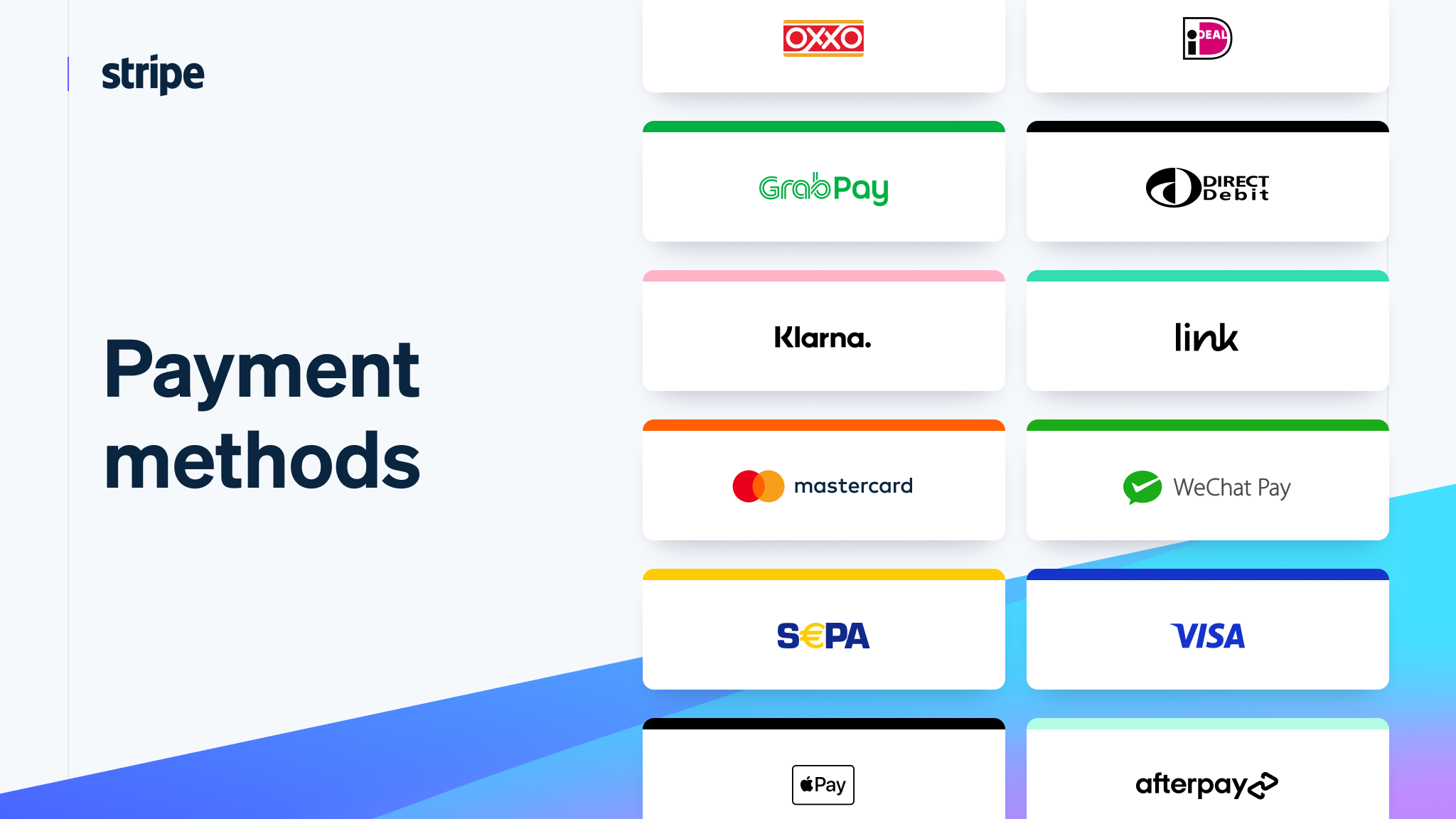

Stripe offers simple integration with popular e-commerce platforms, allowing businesses to set up payment systems quickly and efficiently without the hassle of complex technical processes. - Wide-Ranging Payment Options

Stripe supports a variety of payment methods, from credit cards to digital wallets and international transactions. This flexibility makes it easy for businesses to accommodate customers globally, regardless of payment preferences. - Highly Customizable

Ideal for developers, Stripe enables businesses to tailor their payment systems to fit their exact needs, whether for one-time purchases, subscriptions, or international payments.

- Top-Tier Security and Compliance

Stripe adheres to the highest standards of security, ensuring all transactions are protected and compliant with regulations such as PCI-DSS. Businesses and customers alike can trust that their data is in safe hands. - Real-Time Analytics

Stripe’s advanced reporting features help businesses monitor and optimize their performance. By analyzing transaction data in real time, companies can make smarter, data-driven decisions that boost their bottom line.

Stripe vs. PayPal: Which Payment Solution Reigns Supreme?

While Stripe has garnered attention for its developer-friendly features, PayPal remains one of the largest and most trusted payment platforms across the globe. Here’s a head-to-head comparison of these two industry giants:

User Experience

- Stripe: Built for developers, Stripe excels in providing flexible, customizable payment systems, making it ideal for businesses with complex websites or applications.

- PayPal: Known for its simplicity, PayPal is easy to set up and use, perfect for small business owners or entrepreneurs who need a quick and straightforward way to accept payments.

Transaction Fees

- Stripe: Charges a standard fee of 2.9% + 30 cents per transaction for U.S. credit card payments, with similar rates for international transactions. The platform’s transparent pricing ensures businesses know exactly what they’re paying for, with few hidden fees.

- PayPal: Also charges 2.9% + 30 cents per transaction in the U.S., but additional fees may apply for services like currency conversion or international withdrawals, which could add up quickly for global businesses.

Security and Compliance

- Stripe: With a strong emphasis on security, Stripe adheres to the latest industry standards and regulations, including PCI-DSS and GDPR. It’s a platform that businesses can rely on for secure transactions.

- PayPal: While also secure, PayPal offers a more basic experience, mainly benefiting users who already have PayPal accounts. This simplicity can be a plus for some, but it doesn’t offer the same level of flexibility or detailed transaction management as Stripe.

Payment Options

- Stripe: Supports a vast array of payment methods, including credit cards, digital wallets, and international payments. Stripe’s standout feature is its ability to manage subscriptions and recurring payments with ease.

- PayPal: PayPal also supports credit cards and PayPal balances but doesn’t offer the same extensive range of payment types or the subscription management features that Stripe does.

Global Reach

- Stripe: Available in over 40 countries and supports more than 135 currencies, making it a great option for businesses looking to operate internationally and reach a global customer base.

- PayPal: With a presence in over 200 countries and support for 100+ currencies, PayPal is one of the most widely used platforms for global transactions, making it an excellent choice for international businesses.

Final Verdict: Which Payment Processor is Right for You?

Stripe is ideal for businesses needing a customizable, tech-driven platform with deep integration capabilities, while PayPal is better for small businesses or individuals seeking a simple, easy-to-use payment solution. The choice between the two depends on your business needs, size, and payment management preferences, with both platforms offering valuable tools for success in the digital economy.